Solo roth 401k calculator

The one-participant 401k plan isnt a new type of 401k plan. Or when you are considering rolling money over from a 401k to an IRA you may wish to roll over only a portion of your retirement savings and take the rest in cash.

Self Employed A Solo 401 K Might Be A Good Option For You District Capital

But do you know the true cost.

. In that case the amount of the loan is subject to taxes and possibly penalties. Operating a 401k plan. General guidance on participating in your employers plan.

Solo Roth 401k There is an option to make Roth 401k contributions with the salary deferral portion of the Solo 401k. A Roth IRA is an individual retirement account that offers the opportunity for tax-free income in retirement. Solo 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation.

I understand that you have an outstanding 401k participant loan under your former employer plan. Heres a hypothetical example. Youll need your own business to take advantage of the solo 401k and have no employees other than a spouse but its a powerful savings vehicle if you have a side gig.

In general a Roth is a better option if you expect your. You can rollover almost any type of retirement plan into the Solo 401k including a traditional IRA another 401k plan 403b pension plan TSP etc. Salary Deferral Contribution In 2022 100 of W-2 earnings up to the maximum of 20500 and 27000 if age 50 or older can be contributed to a Solo 401k 2021 limits are 19500 and 26000 if age 50 or older.

The owners spouse may participate in the plan. Along with our expert team sharing best practices articles and guides with you we also provide a Roth Conversion Calculator to compare the two alternatives with equal out-of-pocket costs to estimate the change in total net. Operate and Maintain a 401k Plan.

Step 5 Determine whether the contributions are made at the start or the end of the period. Contribution limits in a one-participant 401k. Contributions to a Roth 401k are after-tax contributions.

To determine the annual retirement contribution you could make based on your income use the Solo 401k Calculator. If you contribute 6000 yearly and realize a 6 average annual return at the end of 20 years you could have 233956 in your retirement account. Roth Solo 401k The facts are the same as above except that Ryan chooses to treat the 10000 deferral as a Roth contribution.

If the loan is not paid back your former employer 401k plan administrator may treat it as a loan offset rather than a deemed distribution. You can do tax deductible traditional Solo 401k contributions to help lower your taxable income. Open Solo 401k Solo 401k Contribution Calculator Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

Roth IRA Calculator. SPACEBAR resumes the slideshow. Its a traditional 401k plan covering a business owner with no employees or that person and his or her spouse.

It may be tempting to pull money out of your 401k to cover a financial gap. It is as if Ryan only made 50000 a year because he is only required to pay taxes on 50000. An S-Corp 401k also called a Solo 401k or a one-participant 401k plan is clearly recognized by the IRS and follows the same regulations as other 401ks with some differences.

The alternative is the Roth solo 401k which offers no initial tax break but allows you to take distributions in retirement tax-free. A Roth solo 401k offers the same contribution limits as a Roth 401k with a normal employer. Unlike a Roth IRA there are no annual income limits.

Step 7 Use the formula discussed above to calculate the maturity amount of the 401k. If your income is too high to contribute to a Roth IRA you can go with a traditional IRA. In addition to high contribution limits there is also a lot of flexibility in how to contribute.

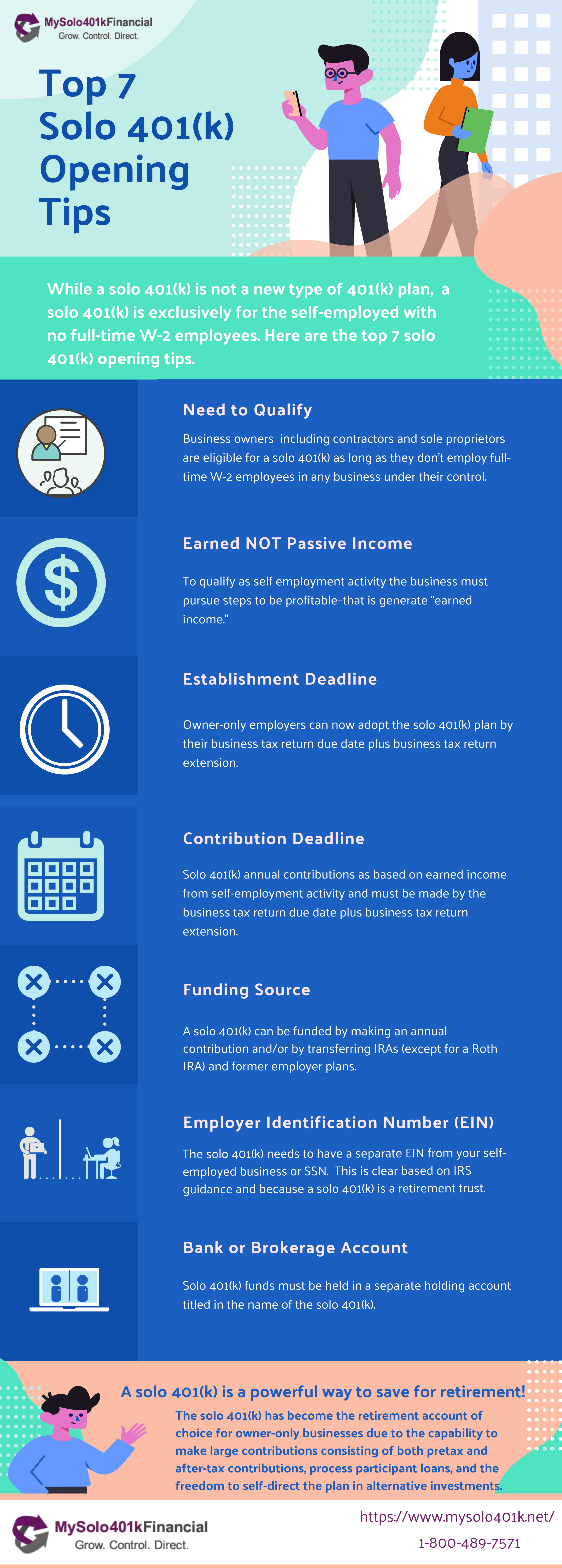

Self-employed individuals and owner-only businesses. A Solo 401k plan is a 401k plan for self-employed business owners with no other full-time employees other than the owner and co-owner or spouse if applicable. Annual contributions are taxed upfront and all earnings are federal tax-free when they are distributed according to IRS rulesThis is much different than a Traditional IRA which taxes withdrawalsContributions can be withdrawn any time you wish and there are no required.

While the annual IRA contribution limit of 6000 may not seem like much you can stack up significant savings. Contributions into a Roth 401k are not tax deductible but withdrawals are tax free. These plans have the same rules and requirements as any other 401k plan.

Tax-deferred growth tax-deductible contributions and pre-tax deferral contributions. For 2022 this limit is 20500 and those 50 and over can make a 6500 catch-up contribution. Correct a 401k Plan.

If you contributed 5 percent of your salary to a 401k plan your contribution would be 96 a pay period but your pay would fall by 82 assuming you were in the 15 percent tax bracket according to a calculator from Fidelity Investments. Or you can also do after-tax Roth Solo 401k contributions. Because the Roth Solo 401k is a subaccount it allows you to convert a portion or even all your Solo 401k funds to Roth.

Youre allowed to. Solo 401k Solo-k Uni-k. Use our 401k Early Withdrawal Costs Calculator first.

Youre now in slide show mode. Mid-year Amendments to Safe Harbor 401k Plans and Notices. How to establish designated Roth accounts in a 401k plan.

Or you can do a combination of both all within the same Solo 401k plan. Hitting pauses the slideshow and goes back. Step 6 Determine whether an employer is contributing to match the individuals contributionThat figure plus the value in step 1 will be the total contribution in the 401k Contribution account.

Non-Roth Solo 401kthe 10000 deferral is treated as pre-tax thereby reducing Ryans income by 10000 to 50000. However the Roth 401k earnings arent taxable if you keep them in the account until youre 59 12 and youve had the account for five years. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

Like a Roth IRA you can contribute up to 6000 a year7000 if youre 50 or olderand you and your spouse can both have an account. Participate in a 401k Plan. Unlike a tax-deferred 401k contributions to a Roth 401k do not reduce your taxable income now when they are subtracted from your paycheck.

Thats where the similarities end. A self-directed SD 401k sometimes called a solo 401k is a way for self-employed individuals to participate in a 401k plan. A Solo 401k plan a SEP IRA a SIMPLE IRA or a Profit Sharing plan.

The only retirement plan that cannot roll into a Solo 401k is a Roth IRA as per IRS rules. Under the Tax Cut Jobs Act that came into effect in 2018 these. Hitting pauses the slideshow and goes forward.

How your savings could add up. For example suppose you had gross pay of 50000 a year and got paid every two weeks.

Here S How To Calculate Solo 401 K Contribution Limits

Solo 401k Contribution Limits And Types

Roth Solo 401k Contributions My Solo 401k Financial

Solo 401 K A Retirement Plan For The Self Employed Individual Rules Travel Credit Cards Small Business Credit Cards Travel Rewards Credit Cards

Making Year 2022 Annual Solo 401k Contributions Pretax Roth And Voluntary After Tax A K A Mega Backdoor My Solo 401k Financial

Solo 401k Contribution Calculator Solo 401k

Solo 401k Contribution Limits And Types

Solo 401k Setup Process Solo 401k

The Solo 401k Benefits My Solo 401k Financial

Cisjnljn Dxwzm

Solo 401k Plans By Nabers Group Self Directed Retirement Experts

Solo Roth 401k Contribution Calculation For Small Business Owner Step By Step Full Walkthrough Youtube

Solo 401k Contribution For Partnership And Compensation

Solo 401k Vs Ira Sense Financial Services

Open Your Solo 401k Solo401k Com

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types